what is hospital indemnity policy

Hospital indemnity is different than a medical plan. What is Metlife indemnity.

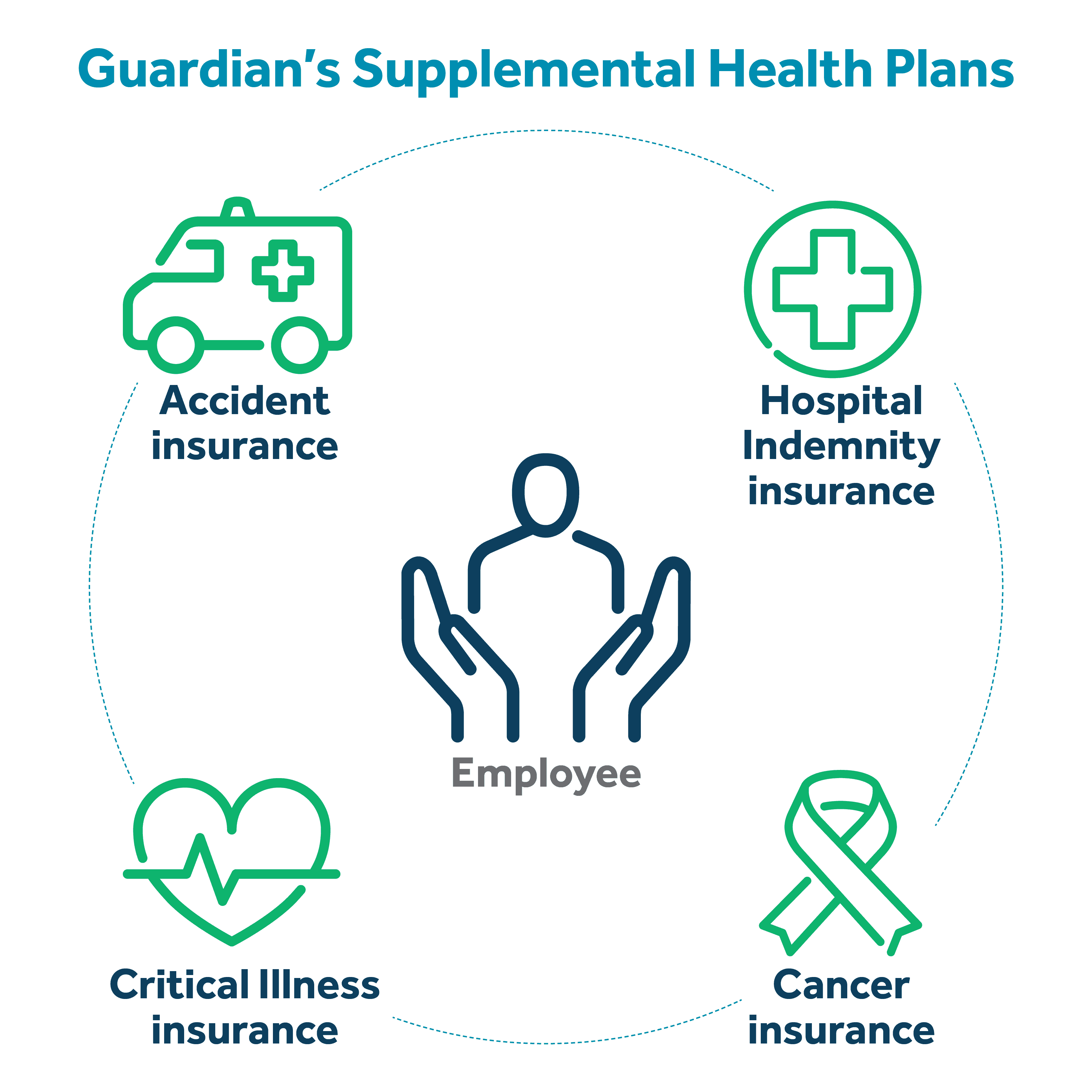

Making Hospital Indemnity Part Of The Mix Guardian

He was admitted to the hospital and stayed for two nights.

. Hospital indemnity insurance is an additional insurance policy you can buy that pays you a fixed amount for each day you spend in a hospital. The policy or its provisions may vary or be unavailable in some states. This limited benefit plan 1 does not constitute major medical coverage and 2.

THIS IS A HOSPITAL CONFINEMENT INDEMNITY POLICY. Prior hospital confinement may be required to receive certain benefits. The policy is not intended to be a substitute.

THE POLICY PROVIDES LIMITED BENEFITS. Hospital indemnity insurance is a supplemental insurance plan designed to pay for the costs of a hospital admission that may not be covered by other insurance. Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for hospital stays.

Theres a common misconception that medical insurance covers all things hospital related but thats often not the. Healthcare facility indemnity insurance policy is actually a kind of supplementary insurance coverage that can assist you steer clear of. Every hospital indemnity insurance plan is different but Aflacs hospital insurance pays the policyholder cash benefits unless otherwise assigned.

Indemnity insurance is an insurance policy designed to protect professionals and business owners when they are found to be at fault for a specific event such as misjudgment. While your current health insurance plan may cover. Full coverage for all hospital stays.

If you have an indemnity plan in place when you need to go to the. Depending on the plan hospital indemnity insurance gives. Hospital indemnity insurance therefore offers advantages that include.

Hospital indemnity insurance is a type of supplemental insurance. Hospital indemnity insurance works as a supplement to your health insurance to help you cover these costs. A hospital indemnity policy is a worthwhile benefit to have for someone who frequents the hospital or if you can afford the security that hospital indemnity insurance.

Jim had bought a Hospital Indemnity Insurance policy some years back for less than 50 cents per day 1 it seemed like a smart. Its an extra way to help you financially if youre admitted to or sometimes just treated in a hospital. Hospital indemnity insurance pays a fixed-benefit at set intervals such as per day week month visit or event rather than a percentage of the bill for covered hospital stays and.

Coverage for expenses not covered by your healthcare plan. Hospital Indemnity Insurance. What is Hospital Indemnity Insurance.

It can help cover out-of-pocket. There may be a preexisting condition limitation for. A Hospital Indemnity plan will give you cash benefits that help pay for the medical expenses associated with a hospital stay.

METLIFES HOSPITAL INDEMNITY INSURANCE IS A LIMITED BENEFIT GROUP INSURANCE POLICY.

Hospital Indemnity Insurance Support American Fidelity

Kemper Health Hospital Indemnity Insurance

The Value Of Hospital Indemnity Insurance L Guardian

Hospital Indemnity Insurance Securian Financial

![]()

Gtl Elite Hospital Indemnity Plan On Vimeo

3 Reasons Why Hospital Indemnity Insurance Is Worth It

Why Hospital Indemnity Insurance Should Be Part Of Every Coverage Portfolio Allstate Benefits

4 Facts You Need To Know About Hospital Indemnity Insurance

What Is Hospital Indemnity Insurance When Is It Worth It Breeze

Hospital Indemnity Insurance Guardian

Mutual Of Omaha Hospital Indemnity Insurance Fill Online Printable Fillable Blank Pdffiller

Hospital Insurance Help For A Hospital Stay Unitedhealthone

What Is Hospital Indemnity Insurance And Is It Worth It Prudential Financial

Hospital Indemnity The Standard

Fixed Indemnity Health Coverage Is A Problematic Form Of Junk Insurance

What Is A Hospital Indemnity Plan